Demand for new apartments in Prague has risen sharply

Demand for new apartments in Prague has risen sharply. Almost 2.5 times more were sold than a year ago, prices stagnated and supply fell slightly

The first quarter of this year brought another significant recovery in demand on the Prague market for new flats. Almost a quarter more apartments were sold than in the previous quarter and almost 2.5 times as many as in the same period last year. A significant impact was mainly due to falling interest rates and improved availability of mortgages. Sales of new homes have thus been rising for five quarters in a row. Prices have remained almost unchanged, while the supply of new flats has fallen slightly. This results from the current market analysis of the development companies Central Group, Skanska and Trigema.

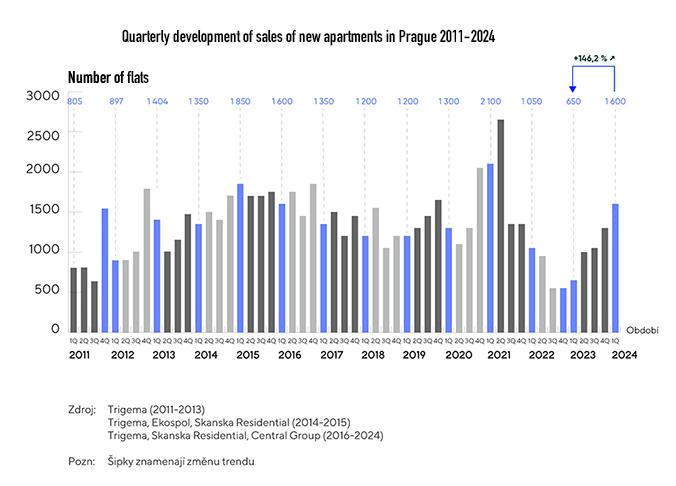

In the first quarter of this year, about 1,600 new flats were sold in Prague, which represents a year-on-year increase of 146%. This significant jump is mainly due to the low comparative base, where the beginning of 2023 (together with the second half of 2022) was the worst sales period in the modern history of the Prague residential market. However, interest in new apartments has been growing for 5 consecutive quarters since then. The number of flats sold in the first three months of this year is 23% higher than in the previous quarter and is the highest number of sales since the record-breaking Q2 2021, when 2,650 flats were sold. The Prague market has thus returned to pre-pandemic levels.

The increased demand is mainly due to falling interest rates and easing mortgage conditions. The mortgage market is a connected vessel with the residential market and in normal times about half of the flats are sold on mortgage. At the beginning of this year, according to the CBA Hypomonitor, the rate for new mortgages was still at 5.65% per annum, while in March it was only 5.19% per annum. At the same time, the CNB should continue to lower the base interest rate, which will also have a positive effect on mortgage rates.

In addition, from 1 January 2024, the DTI limit has been abolished and only the minimum equity requirement for buyers remains in force. This means that buyers who have been delaying their purchase decisions during the previous two years of economic uncertainty and high interest rates are returning to the market in greater numbers. The reduction of the VAT rate for new flats from 15% to 12% for flats up to 120 m², which some developers reflected in their price lists after the New Year, also had a positive effect.

"In the first quarter of this year we witnessed a significant jump in the sales of new flats in Prague, which represents a 146% year-on-year increase. This phenomenon is the result not only of a low comparative base, but also of positive changes in the mortgage market and the reduction in VAT rates. Interest in new apartments has been growing for the fifth quarter in a row and thanks to the easing of mortgage conditions and the fall in interest rates, the market is returning to pre-pandemic levels. This trend indicates renewed buyer confidence and a positive outlook for the future development of the real estate market," summarizes Karel Branda, Deputy Chairman of the Board of Trigema Investment Group

Prices remained stable, with an outlook for growth.

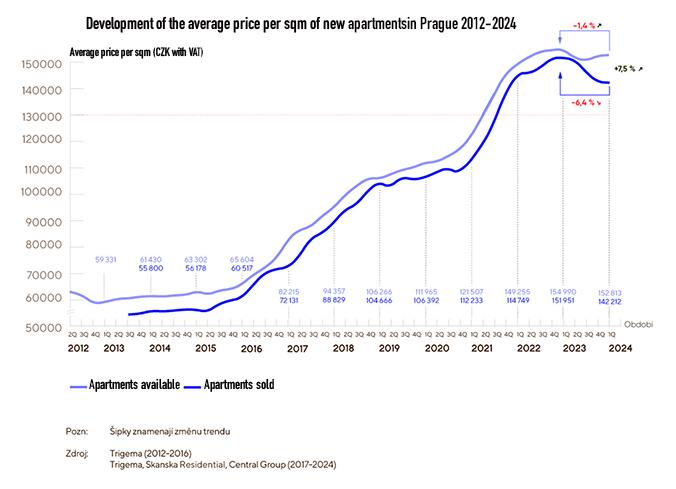

The prices of new flats on the Prague market remained almost unchanged over the last quarter. The average selling price was CZK 142,073 per m² (-0.3% compared to the previous quarter), while the offer price was CZK 152,644 per m² (+0.1%). There was no significant price decline even though the lower VAT rate for flats up to 120 m² became effective on 1 January 2024. Some developers have already reflected this adjustment in their price lists in 2023 and the market has already seen a slight price increase during the first months of this year, which will most likely continue. At the same time, a significant decline in marketing bonuses and discounts can be expected. It remains true that on average the cheapest (CZK 139,614 per m²) new flats can be purchased in Prague 9, where there is also the largest selection of new flats in the whole of Prague.

"The first months of the new year did not affect the average price, despite the fact that the prices of flats in Prague increased in almost a quarter of projects. The three per cent reduction in the VAT rate played a role and new more affordable projects also appeared. The stabilisation of the market will mean a reduction in some bonus programmes, and the return of end clients may also be reflected in less willingness of developers to sell to institutional investors. Given input costs, we expect further modest price increases over the course of the year, averaging units of percent," Petr Michálek, Chairman of the Board of Skanska Residential a.s.

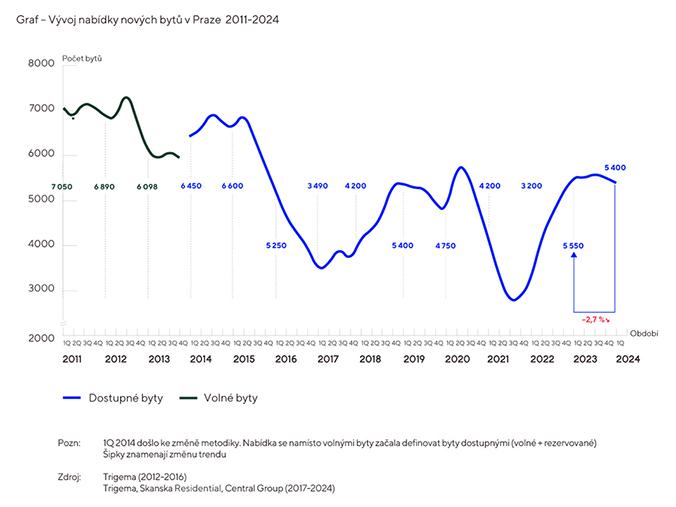

The supply of new flats has fallen slightly and there is no improvement in sight.

There were 5,400 new apartments available in Prague at the end of the first quarter of this year, which is approximately 100 (-1.8%) fewer than at the end of last year. The decline is due to increased demand, but also to the situation in the construction sector, where the still expensive credit financing and persistently high prices of building supplies continue to delay many projects. The supply of housing is also being reduced by the transformation of some projects into rental housing and the slow pace of permitting new construction remains a significant limiting factor. According to the latest CSO data, only 1 025 flats in apartment buildings were permitted in the capital in January and February this year, down by a third year-on-year. And the situation regarding the new construction law, where only a few months before it comes into full effect all the implementing regulations are not yet known, nor whether and to what extent the digitisation of construction procedures will take place, does not yet bring much hope for improvement.

"That the permitting of new buildings in our country is absolutely tragic is common knowledge and perhaps all politicians agree. Therefore, it is absolutely incomprehensible what situation the new construction law and its implementation have gotten into. Two months before such a key law for the entire economy comes into full effect, we do not know what the implementing regulations and digitalisation will look like. The whole market is already panicking and fearing an absolute collapse of permitting. Yet without faster approvals, it is impossible for the supply of apartments to increase and bring about an improvement in housing affordability," concludes Dušan Kunovský, Chairman of the Board of Central Group.

Source: Central Group, Skanska and Trigema